Before you read this article, if you would like to be notified when future articles are published, please hit the 'subscribe' button above to receive a link in your inbox.

This time last week I was returning from a fantastic few days at the LEAP TA Life Sciences conference in Boston where I was proud to present alongside many Talent Acquisition (TA) leaders within the pharmaceutical and life sciences sector. I started my presentation by sharing some insight in to the talent shortages that we're seeing within the sector in the US with the main assertion being that we will see over 1 in 3 jobs vacant by 2030 unless we start to tap in to new talent pools. You can read more on that topic here.

Alongside the insight in to talent shortages I spoke about how TA leaders measure effectiveness today; I shared the metrics most commonly used and some benchmarks for the Life Sciences sector compared to averages for other sectors and regions. Within AMS we will support our enterprise RPO clients to make more than 240,000 permanent hires this year, across 7 key sectors and in more than 90 countries around the world. That level of hiring activity gives us rich data and real insight in to key hiring trends at a sector and regional level.

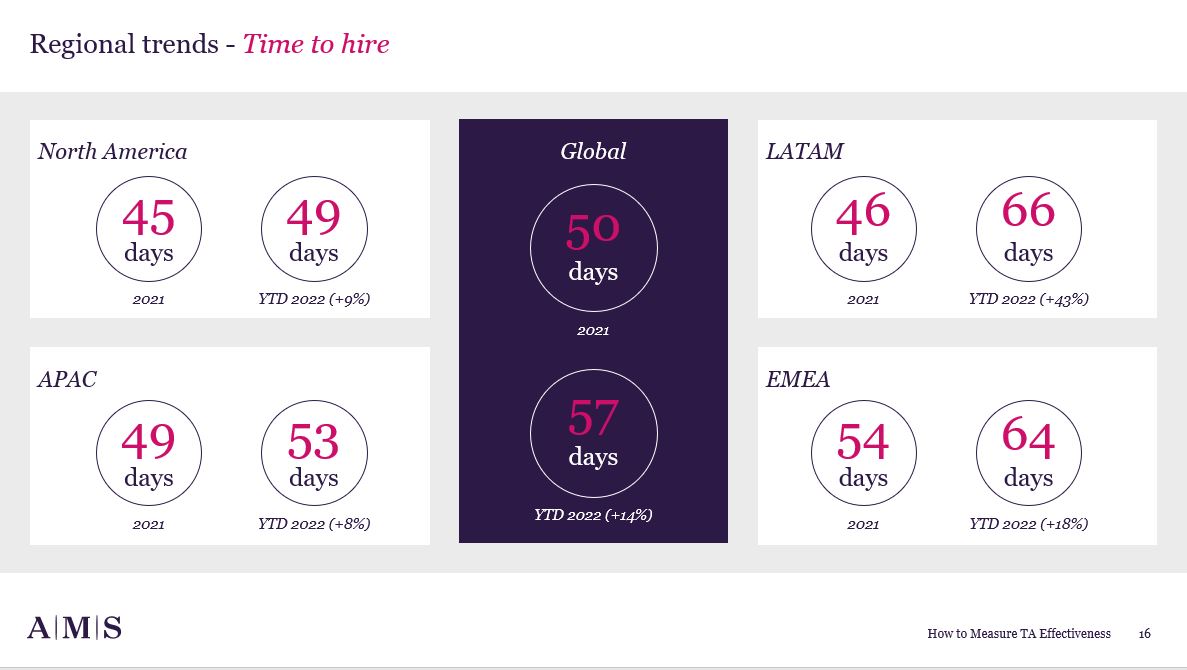

Given the nature of the hiring market in 2022, it's not a surprise to see that overall time to hire (from the point of vacancy approval to the acceptance of a job offer) has increased by 14% from a global average of 50 days in 2021 to 57 days for the year to date. The average time to hire has increased for every region between a low of 8% in APAC and a high of 43% in LATAM as the chart below demonstrates.

The Life Sciences sector has seen similar increases in 2022 over 2021. Global time to hire is averaging 56 days for the first 7 months of this year compared to 52 days for the prior year, an increase of c. 8%. At a regional level the average time to hire has increased by between 6% in EMEA and 32% in LATAM.

At a functional level our data gives greater insight in to the comparable time to hire between roles and regions as the chart below demonstrates. In all regions we see that hiring for 'operations' roles (i.e. manufacturing) and 'sales and marketing' (i.e. commercial) tends to be fastest. Hiring for 'IT, tech and engineering' (i.e. R&D) and Medical Affairs tend to take the longest.

Time to hire is one of a number of metrics that TA leaders use to demonstrate the effectiveness and success of their functions. And it's an important metric - if you ask your business stakeholders what good looks like when it comes to hiring they will undoubtedly tell you that they want the best talent available as fast as possible (and likely at a reasonable cost). So speed to hire is important.

But if you could demonstrate to your business stakeholders that you can make demonstrably better hires, albeit it in a longer timeframe, I strongly suspect that they would prioritize quality of hire over time to hire.

The metrics I've shared in this article are important as operational and tactical measures for talent acquisition. But I would argue strongly that TA leaders need to move beyond these measures towards strategic value measures. And there is no better place to start than with a new definition of quality of hire. More to follow on that point in my next article.

/Passle/61f3d6ce0c51c313c0938277/SearchServiceImages/2025-01-02-09-47-19-044-677660a7640fb9c592204baf.jpg)

/Passle/61f3d6ce0c51c313c0938277/SearchServiceImages/2025-04-23-14-11-26-619-6808f50eb31cfdc7a120ff71.jpg)

/Passle/61f3d6ce0c51c313c0938277/MediaLibrary/Images/2025-04-14-11-50-15-303-67fcf677ce15fc6c97ffb990.png)

/Passle/61f3d6ce0c51c313c0938277/MediaLibrary/Images/2025-04-11-14-18-45-886-67f924c55b0bb6ebfc08c4cd.png)

/Passle/61f3d6ce0c51c313c0938277/MediaLibrary/Images/2025-04-07-09-40-10-787-67f39d7a68569d31a045554b.png)